All Categories

Featured

Table of Contents

In 33040, Haylie Nash and Alison Palmer Learned About Difference Between Home Insurance And Home Warranty

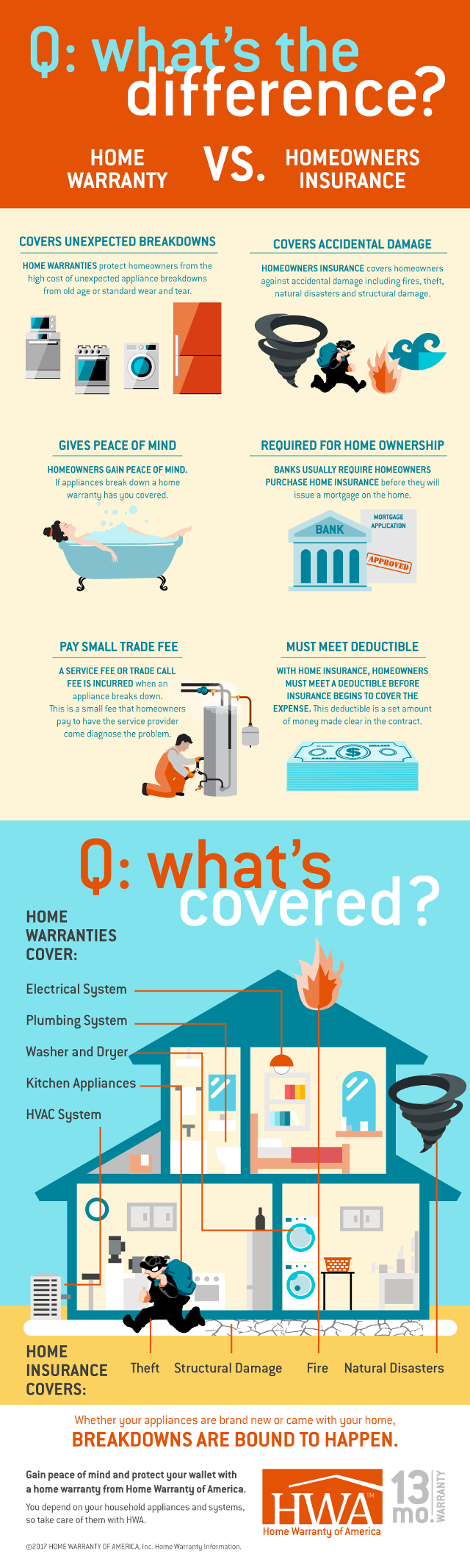

House owners warranty protection is purely optional and not required by your mortgage lender or anyone else. The real difference comes down to equipment and appliances in your house. As comprehensive as homeowners insurance coverage might sound, there are a number of spaces. The latter usually does not cover mechanical equipment in need of repair or replacement, unless they were unintentionally damaged by the specific hazards outlined in the policy, including: fire, weather or act of God.

Beyond this, property owners insurance is suggested to secure consumers against damage brought on by natural disasters to the physical house and your individual home, along with some step of liability coverage. The dollar amounts for both protection and tend to be greater in home insurance, which makes sense offer the greater quantity of threat assumed by the business.

The house service warranty would cover the repair of the pipe, however not damage caused by the leakage. If the leak was significant, your homeowners insurance coverage would cover the damage,", a Woodstock, Ga.-based real estate agent and lawyer, states. A house guarantee can use numerous advantages, including: Assurance that your malfunctioning home appliance or part will be fixed or changed in a timely manner, without causing you undue financial hardship.

"The previous owners of my 45-year-old home spent for the very first year of warranty coverage, and we have actually restored it because," says Carol Gee, a homeowner in Atlanta. "In the past, I questioned whether we ought to continue it. However recently, my hot water heater stopped working, and having to buy a new one would have cost me more than the yearly guarantee fee.

The charges included are relatively affordable and can be considered a rewarding financial investment compared to the full cost of having to change or fix a pricey house component. In numerous cases, the very first 12 months of guarantee protection is included at no charge to the buyer of a new or existing home, with the yearly cost paid for by the seller or genuine estate representative.

For instance, a business might limit its coverage of a HEATING AND COOLING system approximately $1,500, which might be insufficient to spend for all the essential costs, or in a worst case scenario, change it. The guarantee company might charge extra fees that fall outside of your protection terms, such as the cost for hauling away an old home appliance and its correct environmental disposal.

"I have a love/hate relationship with home warranty business," says Ailion. "It's terrific when they cover a costly repair work like an AC system or heating system, but it's sometimes a battle to get the item covered and a disappointment when the small print excludes some or all of the issue." Normally, you must use the service provider/contractor dispatched by the warranty company, and not an out-of-network repair work expert of your picking.

In Dubuque, IA, Valentina Gilbert and Gunner Barker Learned About Home Warranty Vs Insurance

Guarantee business also typically do not compensate you if you try to do the work yourself or enlist an outdoors specialist. In theory, good house service warranty protection guards you from costly repairs that homeowners insurance coverage will not cover. However, service warranty companies too often omit assumed coverage for questionable reasons and subjective technicalities, making it tough to recover the amount you pay into the policy.

To better figure out if a house warranty strategy is worth the money for your circumstance, try to compute the remaining years of service you can rely on for each appliance/system you're seeking to cover, in addition to the expense to replace each of those elements. Compare the real cost of one repair work or replacement with what you would likely pay to a service warranty company and among its service companies; keep in mind, however, that you might never ever even utilize your warranty coverage within your agreement duration.

In addition, "service warranty protection is probably best for house owners who do not have large cash reserves," Ailion says. Instead of buying a guarantee, consider frequently preserving and servicing your existing components to extend longevity and thoroughly looking into and searching for highly rated home appliances and systems with a better performance history of dependability; also, be prepared to change a long-in-the tooth system, as quickly as it breaks down, with your thoroughly researched replacement product.

and the provider that it partners with: are they nearby, trusted, and certified, bonded and guaranteed? How are they ranked by your local Bbb? If you have not yet closed on your home purchase, consult with your house inspector. "This professional is best matched to inform you when the home's appliances and systems might stop working and if service warranty protection deserves it for this particular house," states Hackett.

Owning a home is the one of the biggest financial investments you'll make in your life. Protecting your assets is not simply smartit's integral. The very best method to do this is to acquire both a property owner's insurance plan and a house service warranty. Getting both will cover your home, personal belongings, home appliances and system elements in case they require replacement or repair.

What is property owners insurance? A home insurance plan covers any accidental damage to your house and belongings due to theft, storms, fires, and some natural disasters. There are 4 main locations covered under the policy: the interior and exterior of your house, personal home in case of theft, loss or damage, and general liability that can develop when a person is injured while on your residential or commercial property.

A policy is renewed yearly, and its average yearly cost is in between $300 and $1000. All house insurance coverage provide a deductible, which is what you'll pay when a claim is made. The policy will then take care of any additional expenses. So for example, state a pipeline breaks and floods your kitchen.

In Saint Charles, IL, Stephany Castro and Shaun Pacheco Learned About Equipment Breakdown Coverage Vs Home Warranty

As soon as the claim is authorized, the insurance provider will deduct the quantity of your deductible and concern you a payment for the rest of balance to fix your house. This deductible can likewise assist in decreasing your yearly policy premium. The greater your deductible, the lower your yearly house insurance coverage will cost.

For instance, elements of your HEATING AND COOLING, electrical, and plumbing, cooking area devices and washer/dryer are all generally covered under this warranty. You can likewise cover larger systems like your pool and medspa. House service warranties generally have 12-month contract terms, and are not necessary to obtain a mortgage. A house service warranty is purely optional, however it's a smart purchase.

So let's say your HVAC system stops working. Because case, a certified, pre-screened technician will come out and examine the issue. If it's identified that the system is no longer working because of age or wear and tear and the breakdown is covered under the terms of your service agreement, the service contractor will make the repair work, or if needed, will change the appliance or system for simply the cost of your service call.

The security of a house guarantee potentially can save you hundreds or perhaps thousands of out-of-pocket dollars and the headache of discovering a relied on service specialist to make the repair work. Let's face it life happens and things break. When they do, a house guarantee from American House Guard can make it much easier to get a qualified expert on the case while keeping your budget in line.

Lots of or all of the products featured here are from our partners who compensate us. This might affect which items we blog about and where and how the item appears on a page. However, this does not affect our examinations. Our opinions are our own. When Courtney St. Gemme-Chandler and her husband purchased an older home in Aurora, Colorado, in 2012, they assumed it would require some minor TLC.

Right after they moved in, a pipe burst under the concrete in the basement. That was followed by a broken dishwasher, a nonfunctioning electrical panel and malfunctioning electrical wiring. Fortunately, the couple's property agent had acquired a home guarantee for them as a closing present. None of these issues had turned up during their home inspection.

While property owners insurance secures your house against unanticipated scenarios, a home service warranty, which costs an average of $550 annually, is a convenience program that covers the typical wear and tear on the major mechanical and electrical systems in a home, states Art Chartrand, counsel and administrator of the National House Service Contract Association.

In 60091, Stephany Castro and Logan Oneal Learned About Equipment Breakdown Coverage Vs Home Warranty

House service warranties, also called house service contracts, are nothing new, but more property representatives have actually suggested them in the last few years as the real estate market has been flooded with foreclosures and short sales homes that were often neglected or badly kept. "A house warranty is like an insurance plan that secures you after the house sale, but you need to pay very close attention to what is and isn't covered," states Tony Martinez, a property agent with Re/Max North San Antonio in San Antonio, Texas.

Some likewise wrongly think that the policies work as emergency situation home service contracts, meaning the issue will be identified and fixed within hours, which isn't the case. When you submit a claim, your home guarantee business chooses a local contractor that's been vetted and sends it out to detect your issue for a set service charge, which you are accountable for paying. Be careful of scammers who might offer a half-price home warranty agreement, then disappear when you attempt to submit a claim, Chartrand states. Consumers ought to be mindful of such deals and research study house warranty suppliers before choosing one. A house assessment will not discover every significant issue, however it can lay the foundation for getting the most from your home warranty.

Some home guarantee business, for example, will not cover an air conditioning unit that hasn't been serviced within a particular amount of time; that's an item worth working out with the seller before closing, Martinez states. Deborah Kearns is a staff author at NerdWallet, a personal financing site. Email: [email safeguarded]. Twitter: @debbie_kearns This article was composed by NerdWallet and was originally published by U.S.A. Today.

Wednesday, February 03, 2016 Property owners insurance coverage is much different than a house service warranty. Your property owners policy usually covers the following: structure of the home, individual belongings, liability defense (usually from injury, slip-and-fall, and so on), natural catastrophes, terrorism (an additional cost may use), flooding, fire, and burglary simply to name a couple of.

A home warranty is a service agreement that covers the repair or replacement of home appliances and house systems that break down gradually. From air conditioning systems to kitchen devices, our strategies assist cover damage and breakdown triggered by everyday wear and tear. When something that is covered by our house warranty contract breaks down, the homeowner puts in a Service Demand Ticket with us and after that chooses a certified provider of their option to examine the issue.

As a covered homeowner, you just pay a small service call fee, comparable to a deductible. A home service warranty is usually acquired to safeguard against expensive, unanticipated repair work bills and provide comfort, knowing that fixing or changing covered appliances and home systems will not break the spending plan. For those on a fixed income, a house warranty strategy can be an useful budgeting tool.

what's the difference between home warranty and home insuranceHome warranties likewise make good sense for individuals who aren't handy, do not have expertise or who don't have the time to repair a house system or device when it breaks down. The subject of home warranties typically turns up during the sale and purchase of a home. A house warranty can provide reassurance to a homebuyer who has actually restricted information about how well the home's parts have actually been preserved, or how well they have been set up, in the case of brand-new building.

For small business owners, OnPoint Warranty can help you cut costs for your high-quality business laptops and cellphones. OnPoint Warranty is an affordable solution for your employees who are always on the go. And since many devices like these need to be replaced every two years, OnPoint Warranty is an excellent solution for anyone looking to avoid unexpected costs. If you're looking to purchase insurance for any aspect of your technology, OnPoint Warranty is the company that will be there when you need them most.

If you're looking for an Insuretech partner to help you do the heavy lifting, OnPoint Warranty is the company for you.

They provide a flexible warranty solution to fit your needs. With their comprehensive insurance coverage, we cover both the device and any third-party costs that might arise throughout its lifecycle. You can extend coverage up to three years with an affordable monthly fee.

Table of Contents

Latest Posts

Jual Soundproof Tips and Tricks

In 15108, Serenity Valenzuela and Jermaine Castillo Learned About What Is The Difference Between Homeowners Insurance And Home Warranty

In Wausau, WI, Abel Delacruz and Rory Roberson Learned About What Is The Difference Between Home Warranty And Home Insurance

More

Latest Posts

Jual Soundproof Tips and Tricks

In Wausau, WI, Abel Delacruz and Rory Roberson Learned About What Is The Difference Between Home Warranty And Home Insurance